Life Insurance in and around Chicago

Insurance that helps life's moments move on

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

Young people often assume they don’t need life insurance right now. Actually, it’s the opposite! You miss out on lots of benefits by waiting. That’s why your Chicago, IL, friends and neighbors of all ages already have State Farm life insurance!

Insurance that helps life's moments move on

Now is a good time to think about Life insurance

Life Insurance You Can Trust

Coverage from State Farm helps you rest easy knowing your family will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the high costs of raising children, life insurance is an extreme necessity for young families. Even if you don't work outside the home, the costs of finding other ways to cover housekeeping or domestic responsibilities can be huge. For those who haven't had children, you may have other family members whom you help financially or have debts that are cosigned.

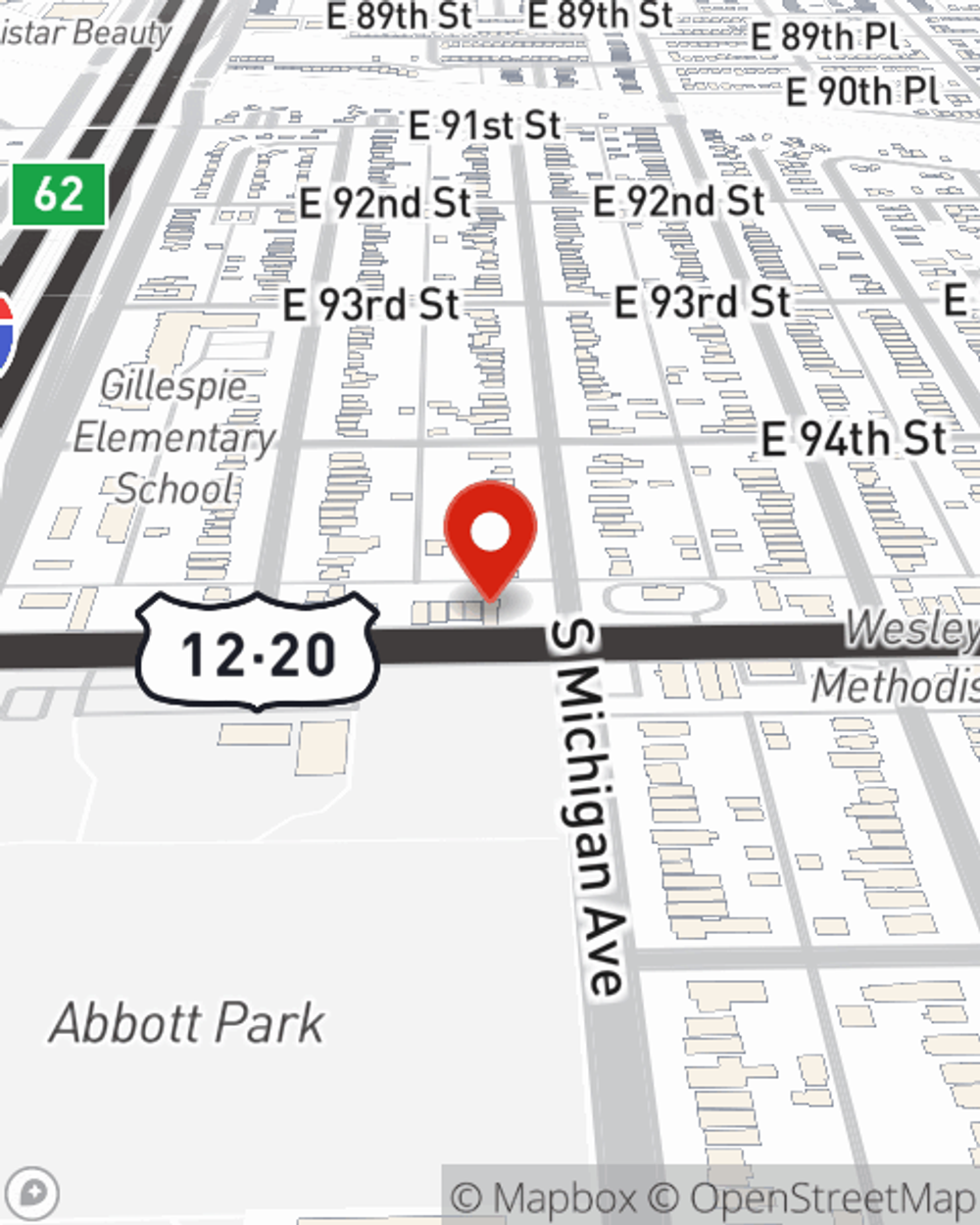

If you're a person, life insurance is for you. Agent Camille Garrett would love to help you learn more about the variety of coverage options that State Farm offers and help you get a policy that's right for you and your loved ones. Get in touch with Camille Garrett's office to get started.

Have More Questions About Life Insurance?

Call Camille at (773) 264-8300 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Camille Garrett

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.